BTC Price Prediction: Analyzing the Path to $125,000 Amid Market Consolidation

#BTC

- Bitcoin is consolidating below key resistance with improving technical indicators suggesting potential upward movement

- Mixed news sentiment balances cautionary warnings with positive institutional developments and product innovations

- The $125,000 price target remains achievable with a break above current resistance levels and sustained accumulation patterns

BTC Price Prediction

BTC Technical Analysis: Consolidation Phase with Bullish Potential

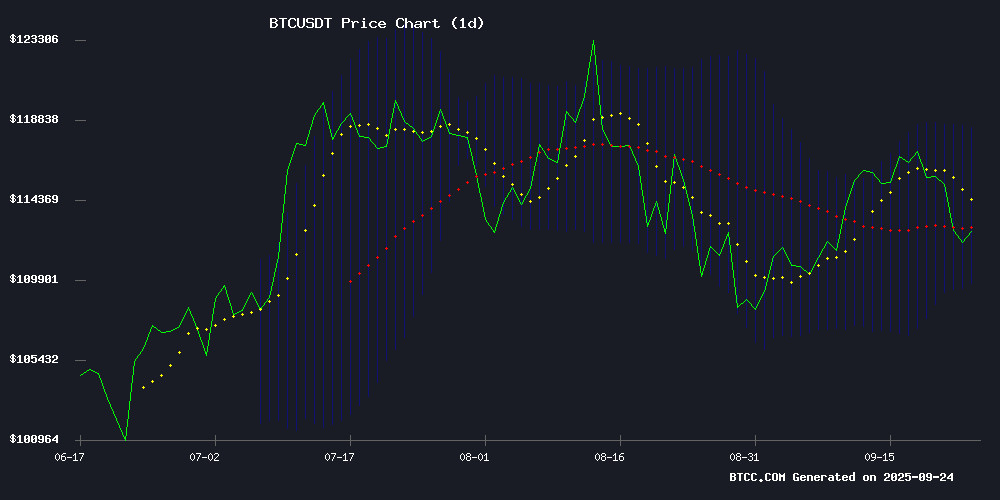

According to BTCC financial analyst Michael, Bitcoin is currently trading at $112,550.38, slightly below its 20-day moving average of $114,083.28, indicating a short-term consolidation phase. The MACD shows improving momentum with a positive histogram reading of 136.6981, suggesting weakening bearish pressure. Bitcoin is trading within the Bollinger Bands with support at $109,722.06 and resistance at $118,444.49. Michael notes that a break above the 20-day MA could trigger a move toward the upper Bollinger Band.

Mixed Market Sentiment as Bitcoin Faces Key Resistance

BTCC financial analyst Michael observes that current news sentiment presents a balanced picture. While some analysts warn of potential declines below $100,000, positive developments like Fold's bitcoin rewards card partnership and substantial BTC accumulation in new wallets provide underlying support. Michael emphasizes that the technical consolidation phase aligns with the mixed fundamental backdrop, suggesting the market is seeking direction amid contrasting signals.

Factors Influencing BTC's Price

Analysts Warn Bitcoin Price Decline May Deepen Below $100,000

Bitcoin's recent breakdown below $112,000 confirms bearish technical patterns identified by crypto analysts. The digital asset now faces mounting pressure as critical support levels give way.

Technical analyst HAMED_AZ had flagged Bitcoin's descent within a descending channel prior to the sell-off. The breach of a short-term ascending trendline and rejection at the 61.8% Fibonacci level near $117,000-$120,000 accelerated downward momentum. Market structure suggests further downside unless Bitcoin reclaims the $118,000-$120,000 resistance zone.

The current correction reflects broader market weakness as traders unwind positions. Historical patterns indicate such breakdowns often lead to extended declines before establishing new accumulation zones. Market participants now watch for potential stabilization signals as bitcoin approaches psychological support at $100,000.

Novogratz Predicts Crypto Policy Shift Will Disrupt Market Cycles

Galaxy Digital CEO Mike Novogratz asserts that recent U.S. regulatory advancements—the GENIUS Act and CLARITY Act—will catalyze unprecedented institutional participation in crypto markets, potentially breaking Bitcoin's four-year cycle pattern. "It's a big deal," Novogratz told Bloomberg. "These legislative bookends unleash new capital flows."

Traditional cycle theories face scrutiny as stablecoin legitimacy and clearer jurisdictional guidelines remove barriers to adoption. Unlike previous bull runs, Novogratz anticipates sustained investor engagement beyond typical year-end sell-offs, noting: "People can now legally use stablecoins in mainstream apps—that changes everything."

Coinbase CEO Brian Armstrong reinforced the sentiment, likening the CLARITY Act's impact to a "freight train" of institutional adoption. The convergence of regulatory clarity and technological integration suggests a structural market shift rather than cyclical fluctuation.

Bitcoin Price Struggles Under Resistance as Bears Loom

Bitcoin extended losses after breaking below the $114,000 support level, now consolidating NEAR $111,557. The failure to hold above $115,500 has shifted momentum toward sellers, with a bearish trend line forming at $113,600 on the hourly chart. A decisive close above $114,000 is needed to invalidate the downtrend.

The 100-hour moving average reinforces resistance as BTC tests the $110,500 support zone. Market structure suggests caution—while oversold conditions could spark a rebound, the path of least resistance favors further downside unless bulls reclaim $114,000.

Fold Launches Bitcoin-Only Rewards Credit Card via Visa and Stripe Partnership

Fold Holdings unveiled its Bitcoin rewards credit card, operating on the Visa network through a collaboration with Stripe. The card offers up to 3.5% back in Bitcoin on all purchases, with no category restrictions or deposit requirements. Instant rewards of 2% are provided on all spending, with an additional 1.5% for payments made via a Fold Checking Account.

Enhanced rewards of up to 10% are available when shopping with major partners like Amazon, Target, and Starbucks. Despite the card's strong value proposition, Fold's shares (FLD) tumbled over 15% following the announcement, dropping from $4.69 to $3.26.

"Our credit card makes Bitcoin easily accessible to everyone," said Fold CEO Will Reeves. The launch timeline remains undisclosed. Stripe, the payment infrastructure provider, reported handling over $3.1 billion in transactions.

Bitcoin Dip-Buying Hype Sparks Contrarian Warning from Santiment

Bitcoin's recent price plunge has triggered a surge in 'buy the dip' chatter across social media platforms, but analytics firm Santiment cautions this enthusiasm may signal further downside. Retail traders are flooding forums with calls to capitalize on lower prices, as measured by a 25-day high in Bitcoin-related 'Social Volume' metrics tracking dip-buying terminology.

Historical patterns suggest crowd euphoria often precedes contrary price action. 'Prices typically move opposite to the crowd's expectations,' Santiment notes, drawing parallels to past instances where rampant dip-buying calls preceded extended declines. The firm's data shows retail traders are currently exhibiting maximum Optimism since the April market correction.

Peter Brandt's Investment Strategy: Bitcoin, Real Estate, and SPY for Gen Z

Veteran trader Peter Brandt has outlined a strategic investment blueprint for Generation Z, emphasizing Bitcoin's role as a hedge against inflation and market volatility. "Bitcoin is the asset that matters," Brandt asserts, recommending a 10% portfolio allocation to capture its asymmetric upside while cautioning against speculative short-term plays.

The proposed model balances digital and traditional assets: 20% in inflation-resistant real estate and 70% in S&P 500 index funds (SPY) for diversified equity exposure. This triad approach aims to preserve wealth amid fiat currency devaluation while leveraging the growth potential of established corporations.

Brandt's guidance challenges young investors chasing quick gains in crypto trading or derivatives markets. His framework prioritizes long-term wealth preservation over speculative trading, particularly for those with less than three years of market experience.

Bitcoin Market Sees Over 73,000 BTC Influx Into Wallets Younger Than 1 Month – Is A Rally Near?

Bitcoin's recent stagnation in the low $110,000 range belies a significant shift beneath the surface. On-chain metrics reveal a surge of fresh capital entering the market, with the Net Position Change (NPC) for wallets holding BTC less than one month swinging decisively into positive territory. This cohort absorbed 73,702 BTC on September 23 alone—a notable reversal from prior outflows.

Long-term holders continue taking profits at a rate of -145,000 BTC, characteristic of bull market behavior. Yet the robust demand from new entrants suggests underlying strength. When veteran investors distribute and newcomers accumulate, it often precedes upward momentum—a dynamic now playing out in real-time.

MicroStrategy's Bitcoin Bet Overshadows Its Software Business

MicroStrategy (MSTR) has transformed from a data analytics firm into the world's largest corporate holder of Bitcoin, with its cryptocurrency holdings now driving the majority of its financial performance. The company reported $115 million in software revenue for Q2 2024, dwarfed by $14 billion in net income—99% of which came from unrealized Bitcoin gains.

Chairman Michael Saylor's 2020 pivot to Bitcoin has proven prescient. MSTR shares have surged 2,000% over five years, more than doubling Bitcoin's 940% appreciation. Unlike spot Bitcoin ETFs, MicroStrategy employs leverage—using its BTC holdings as collateral to acquire more—creating amplified exposure for investors.

The company's market performance underscores how traditional firms can reinvent themselves through crypto adoption. With 214,246 BTC ($14B) on its balance sheet, MicroStrategy has effectively become a publicly traded Bitcoin proxy, though its enterprise analytics business continues operating.

Bitcoin Enters Consolidation Phase After Volatility Surge

Bitcoin's market has transitioned into a consolidation phase following a period of extreme volatility, marked by sideways price movement within a tight range. This intraday chop, while challenging for short-term traders, represents a natural stabilization period after significant price action.

Crypto analyst Uniswap Gems observes that the recent volatile move caught many participants off guard. The current phase could persist for 2-3 days as the market establishes a foundation for its next directional move. Key levels to watch include $113,000 as potential support, with a break above potentially testing $115,000. Conversely, failure to hold current levels may trigger a drop toward $105,000.

OranjeBTC to Go Public in Brazil with $400M Bitcoin Treasury

OranjeBTC, a bitcoin-focused company in Latin America, is set to list on Brazil’s B3 exchange via a reverse merger with Intergraus in early October. The firm holds over $400 million in Bitcoin reserves, positioning it as the largest publicly traded bitcoin treasury company in Brazil. With 3,650 BTC—six times more than its nearest competitor, Méliuz—OranjeBTC ranks among the top 25 corporate bitcoin holders globally.

Backed by high-profile investors like the Winklevoss twins, Blockstream’s Adam Back, and Mexican billionaire Ricardo Salinas Pliego, the company plans to expand its bitcoin holdings further. Institutional support from funds such as Off the Chain Capital and ParaFi Capital underscores confidence in its strategy. OranjeBTC also aims to leverage Intergraus’ educational infrastructure to launch a financial education platform.

Bitcoin Price Prediction Eyes $125,000 Yet Experts Back Rollblock As The 30x Candidate

Bitcoin's dominance in the cryptocurrency market is under scrutiny as analysts project a potential surge to $125,000, while Rollblock emerges as a dark horse with its presale rallying over 500% and raising $11.8 million. Early investors are touting Rollblock as a possible 30x performer by 2025, shifting the debate from Bitcoin's ceiling to which asset offers sharper returns.

Bitcoin currently trades at $112,723.24, with $53.3 billion in daily volume, after dipping below $115,000 earlier this week—a 12-day low. The MOVE triggered massive liquidations, wiping out $1.7 billion in long positions within an hour. The $112,000 support level now serves as a critical threshold; failure to hold could see Bitcoin slide toward $110,000 or even $106,000. Conversely, reclaiming $115,000 may reignite bullish momentum toward $125,000.

How High Will BTC Price Go?

Based on current technical indicators and market developments, BTCC financial analyst Michael projects Bitcoin could reach $125,000 in the medium term. The current consolidation below the 20-day moving average at $114,083 provides a foundation for upward movement once resistance is broken. Key factors supporting this prediction include:

| Factor | Current Status | Price Impact |

|---|---|---|

| Technical Resistance | $118,444 (Upper Bollinger Band) | Breakout could accelerate gains |

| MACD Momentum | Improving bullish divergence | Supports upward movement |

| Institutional Accumulation | 73,000 BTC in new wallets | Strong underlying demand |

| Market Sentiment | Mixed but stabilizing | Reduced selling pressure |

Michael cautions that maintaining above $109,722 support is crucial for the bullish scenario to unfold.